If the company wanted to, it could pay out all of that money to its shareholders through dividends. However, the company typically reinvests the money into the company. Shareholders’ equity reflects how much a company has left after paying its liabilities.

BOX 15.3 NET WORTH STATEMENT EQUATION

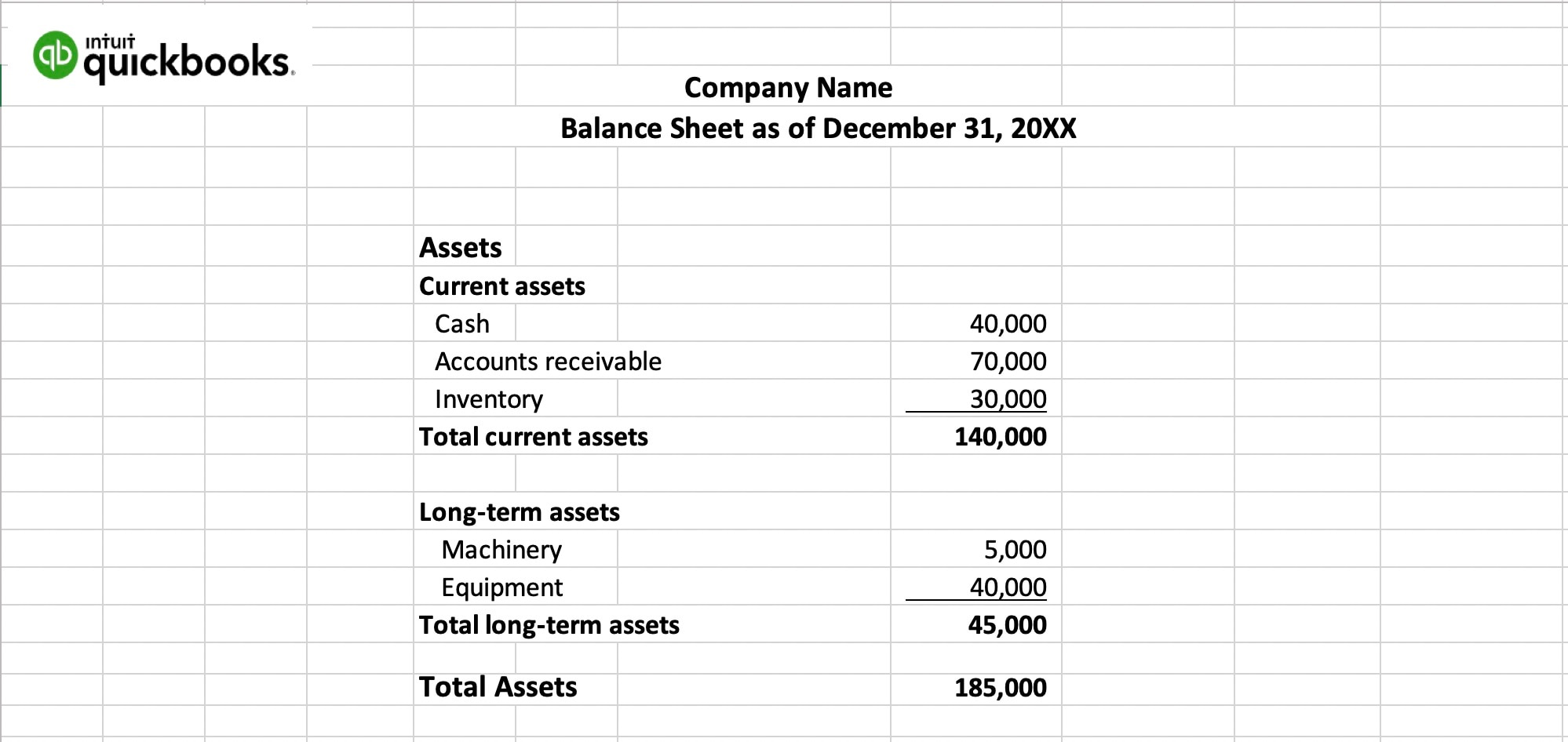

Below the assets are the liabilities and stockholders’ equity, which include current liabilities, noncurrent liabilities, and shareholders’ equity. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

Company

Current assets are typically those that a company expects to convert easily into cash within a year. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. It’s important to note that the balance sheet should always balance.

Free Course: Understanding Financial Statements

Examples of activity ratios are inventory turnover ratio, total assets turnover ratio, fixed assets turnover ratio, and accounts receivables turnover ratio. This shows that someone is accumulating wealth and paying off loans. A person can increase assets by either saving money or increasing the value of an asset.

This statement looks at the sources and uses of personal family money. The exact categories of income and expense will differ depending on the person’s situation. If, for example, someone is not married, then a spouse’s income is meaningless.

- However, there are instances where it might not because a mistake has been made in the process.

- Financial ratio analysis is the main technique to analyze the information contained within a balance sheet.

- For instance, the balance sheet can be used as proof of creditworthiness when the company is applying for loans.

- This balance sheet template includes tallies of your net assets — or net worth — and your working capital.

- Adding total liabilities to shareholders’ equity should give you the same sum as your assets.

Ask Any Financial Question

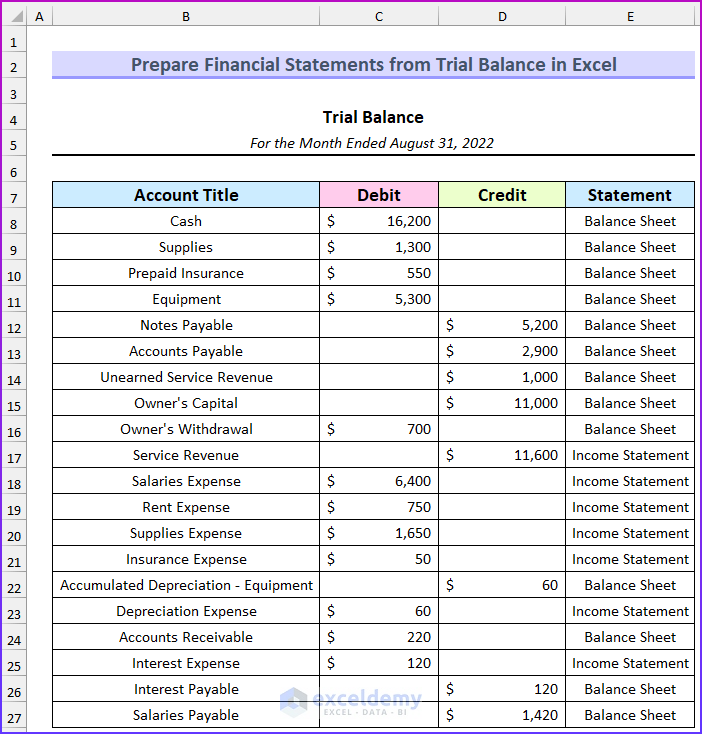

Owner’s equity comprises the capital invested by the owner and any retained earnings. The column of amounts that is closest stripe in xero tothe words will be the most recent amounts. The column furthest from the words will contain theoldest amounts.

You’ll get bank details for the US, UK, euro area, Poland, Australia and New Zealand, to receive fee-free payments from these regions. Hold 40+ different currencies, and switch between them using the mid-market exchange rate — and up to 3x cheaper than an alternative like PayPal. The balance sheet of Apple (AAPL), a global consumer electronics and software company, for the fiscal year ending 2021 is shown below. Assets describe resources with economic value that can be sold for money or have the potential to provide monetary benefits someday in the future.

If the automobile is purchased with debt (borrowing the money for the purchase), the net worth statement will remain unchanged. Payments for the automobile loan are part interest, which goes away to the bank, and part principal, which decreases the loan liability, improving the net worth statement. However, the asset decreases in value as it ages, canceling out most of the decrease in liability. This happens to young professionals who have significant educational debt and few assets. Their total liabilities (educational and other debts) are more than the total of what they presently own (assets).

This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. When completing your taxes or providing financial information to regulatory authorities. In some cases, businesses are required to submit their balance sheet and other financial statements for tax purposes. A balance sheet is an important financial statement that summarizes a business’s financial situation. Balance sheets are used to evaluate a company’s performance and ability to meet its financial obligations.

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail. As you can see, the report form is more conducive to reporting an additional column(s) of amounts. Now that you have an idea of how values are recorded in several accounts in a balance sheet, you can take a closer look with an example of how to read a balance sheet.

You can think of it like a snapshot of what the business looked like on that day in time. According to Generally Accepted Accounting Principles (GAAP), current assets must be listed separately from liabilities. Likewise, current liabilities must be represented separately from long-term liabilities. Current asset accounts include cash, accounts receivable, inventory, and prepaid expenses, while long-term asset accounts include long-term investments, fixed assets, and intangible assets. Unlike the income statement, the balance sheet does not report activities over a period of time. The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day.