The term refers to the relationship, or ratio, of a business’s debt-to-equity (D/E). Gearing shows the extent to which a firm’s operations are funded by lenders vs. shareholders. The gearing ratio calculated by dividing total debt by total capital (which equals total debt plus shareholders equity) is also called debt to capital ratio. It’s also important to remember that although high gearing ratio results indicate high financial leverage, they don’t always mean that a company is in financial distress. While firms with higher gearing ratios generally carry more risk, regulated entities such as utility companies commonly operate with higher debt levels.

How do gearing ratios work?

A market analyst and member of the Research Team for the Arab region at XS.com, with diplomas in business management and market economics. Since 2006, she has specialized in technical, fundamental, and economic analysis of financial markets. Known for her economic reports and analyses, she covers financial assets, market news, and company evaluations. She has managed finance departments in brokerage firms, supervised master’s theses, and developed professional analysis tools. Additionally, boosting profits through better cost management and improved cash flow can provide extra funds to pay off debt faster. Lastly, consider selling non-essential assets to generate immediate cash that can be used to further reduce debt.

Markets

The following information has been taken from the balance sheet of L&M Limited. Since this is less than 4 and does not meet the bank’s expected ratio, it will now have to provide a guarantor or mortgage of the property as stipulated. Nathalie Okde is an SEO content writer with nearly two years of experience, specializing in educational finance and trading content.

Liquidity Ratios (Financial Ratios Explained)

Therefore, the higher the proportion of debt to equity, the lower a company’s weighted average cost of capital (WACC). In fact, debt is typically cheaper than equity and it also reduces the amount of money that shareholders need to invest into a business. When invested properly (i.e., return on investment is higher than the cost of debt), leverage can help boost profits. Investors and analysts can better comprehend a company’s financial standing and capacity to pay its debts by examining its gearing ratio. Lenders and investors frequently use this ratio to evaluate a company’s creditworthiness and future loan repayment capacity.

By comparing the gearing ratio with other financial ratios, stakeholders can gain a more nuanced understanding of a company’s financial health and risk profile. A good gearing ratio indicates a balanced approach to leveraging debt and equity, providing the company with financial flexibility and stability. This formula provides a more refined view of a company’s financial health by considering its ability to cover debt with cash, making it especially useful for understanding real leverage. On the other hand, a lower gearing ratio indicates a reliance on equity financing, which is typically considered safer but might limit growth potential. Shareholders’ equity is the portion of a company’s net assets that belongs to its investors or shareholders.

- Financial gearing, or leverage, is the use of debt–as opposed to equity–for the purpose of business financing, with the aim that the return generated will exceed the borrowing costs.

- Further, the price setting of the loan and other terms are also dependent on the same.

- Put simply, it tells you how much a company’s operations are funded by a form of equity versus debt.

- In addition, it is calculated by subtracting a company’s total liabilities from its total assets.

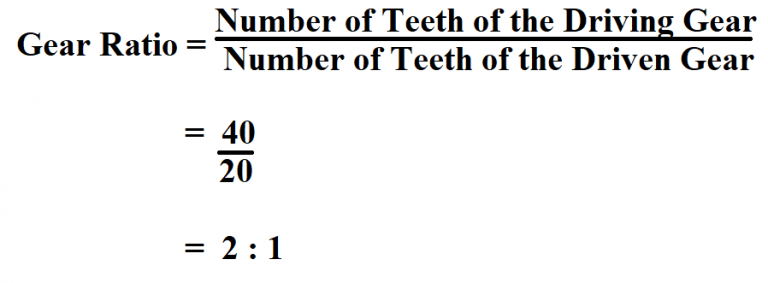

- Gear is a round wheel that has teeth that mesh with other gear teeth, allowing the force to be fully transferred without slippage.

A high gearing ratio can be a blessing or a curse—depending on the company and industry. Having a high gearing ratio means that a company is using more debt to fund its operations, which may increase the financial risk. But high ratios may work well for certain companies, especially if they are capital-intensive as it shows they are investing in their growth.

(Times Interest Earned Ratio represents the company’s total earnings as a percentage of the interest that the company has paid. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Based on the following details, you need to assess whether ABC meets the bank’s expectation of gearing ratio. The last thought would be the company needs to maintain an adequate debt ratio that fits its best. A company’s times interest earned ratio is arrived at by dividing its earnings before interest and taxes (EBIT) by its interest expenses. However, we need to add the current year’s profit amounting to $2,000 in the opening capital.

So, it’s a good sign for lenders because they can recover their dues easily in case of business default. Although there is no absolute guide to what an ideal gearing ratio should be, a general rule of thumb suggests minimum 25% and maximum 50% leverage a refresher on internal rate of return ratio as a safe benchmark. This variation is useful when most of a company’s debt is long-term, but not when a company has a large amount of short-term debt (e.g., when creditors are not willing to extend long-term lending to the company).